How do I sell my home fast in New Haven, CT without cutting my price? — Heike Severine’s advice

**How do I sell my home fast in New Haven, CT without cutting my price?**

To sell your home quickly in New Haven County without dropping your price, you need a balanced strategy — realistic pricing, small but high-impact improvements, and expert local marketing.

Why fast doesn’t have to mean cheap

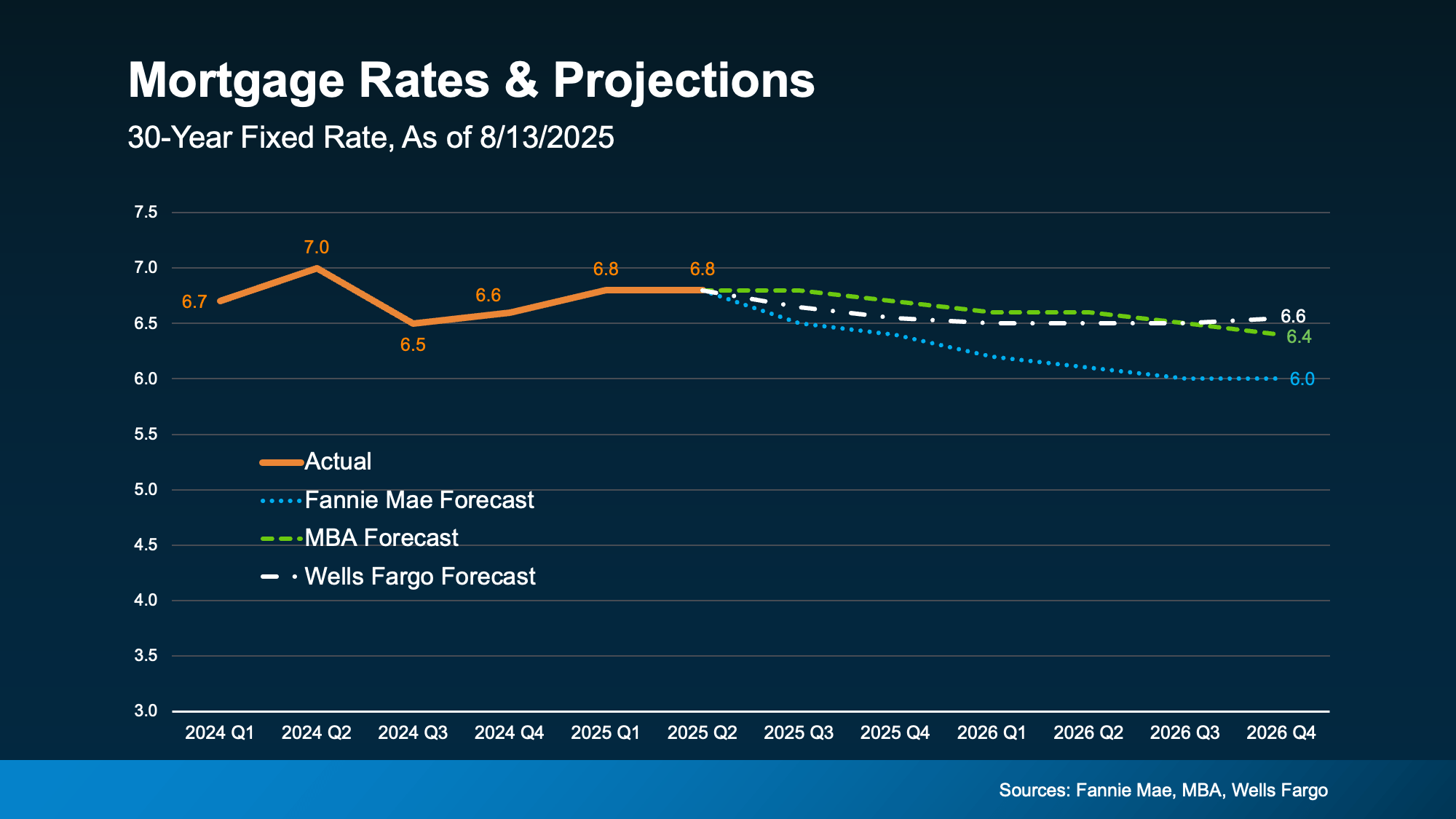

If you’re thinking about selling, you’ve probably heard two conflicting pieces of advice: “price it high and negotiate” versus “price it low to sell fast.” The truth? Neither extreme works in today’s Connecticut market. The homes that sell fastest and for the best terms are the ones priced right from the start and supported by local marketing.

I’ve helped dozens of sellers across New Haven, Hamden, Wallingford, Milford, and Branford get quick, strong offers — without panic discounts. Let’s talk about how that’s done.

A quick look at the local market

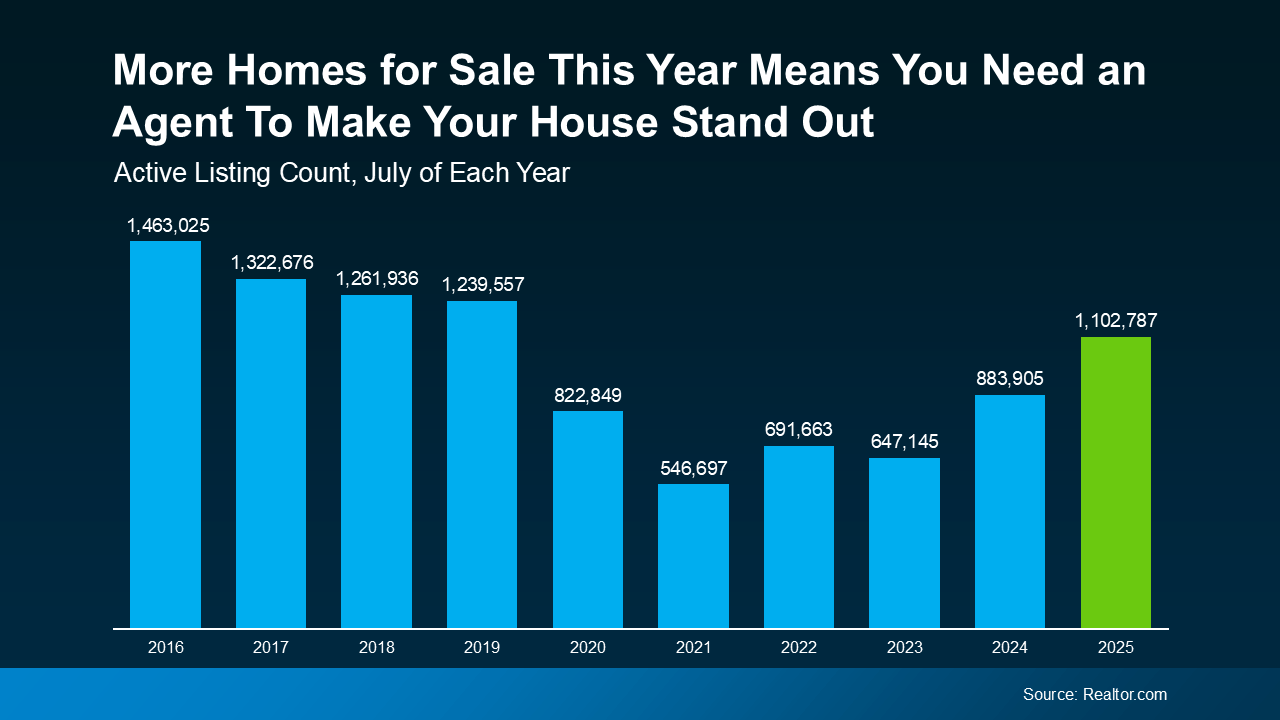

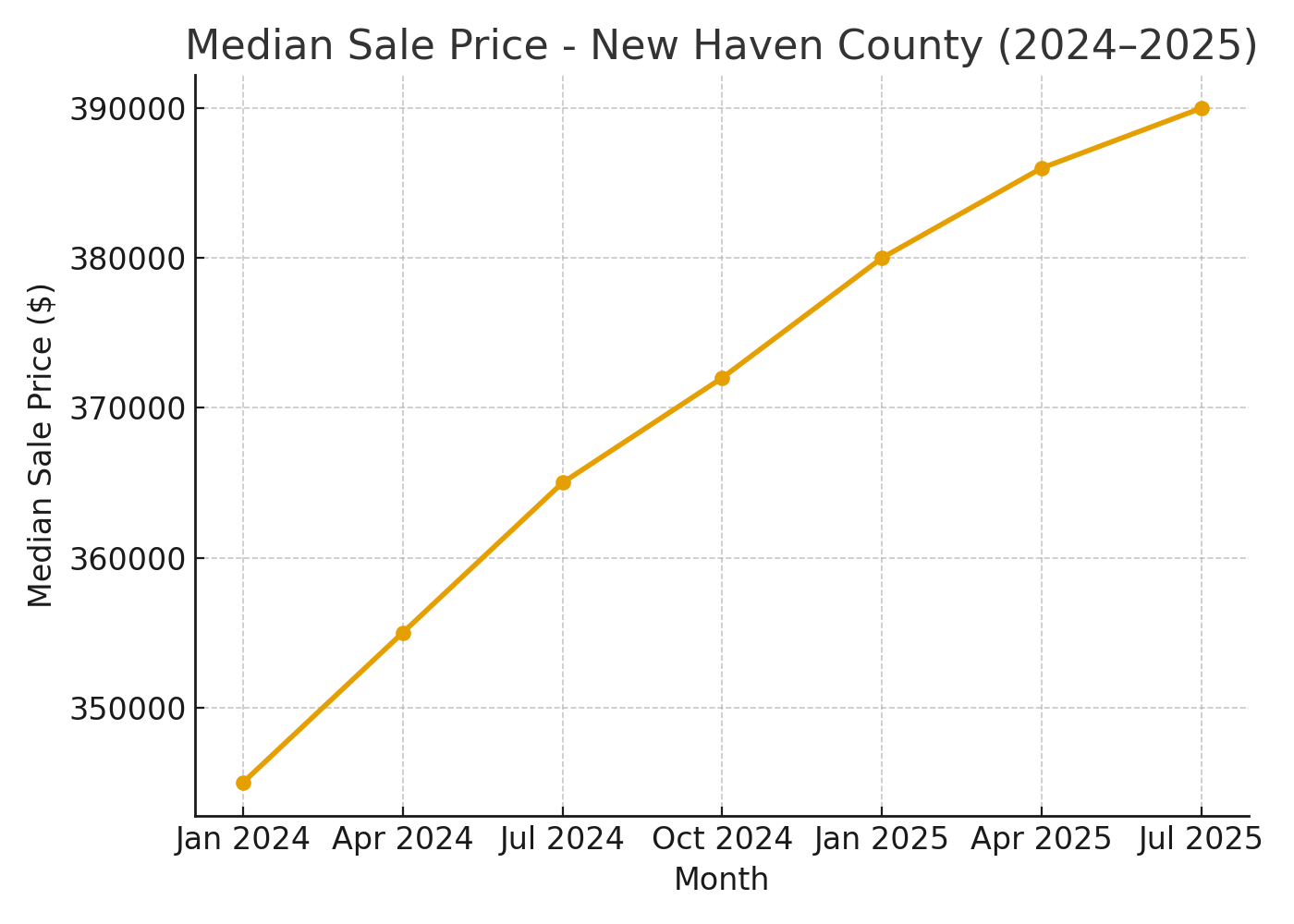

New Haven County is still very much a seller’s market — but it’s shifting. Here’s what’s happening:

- The median sold price hit about $386,000 in April 2025, up roughly 8% year-over-year.

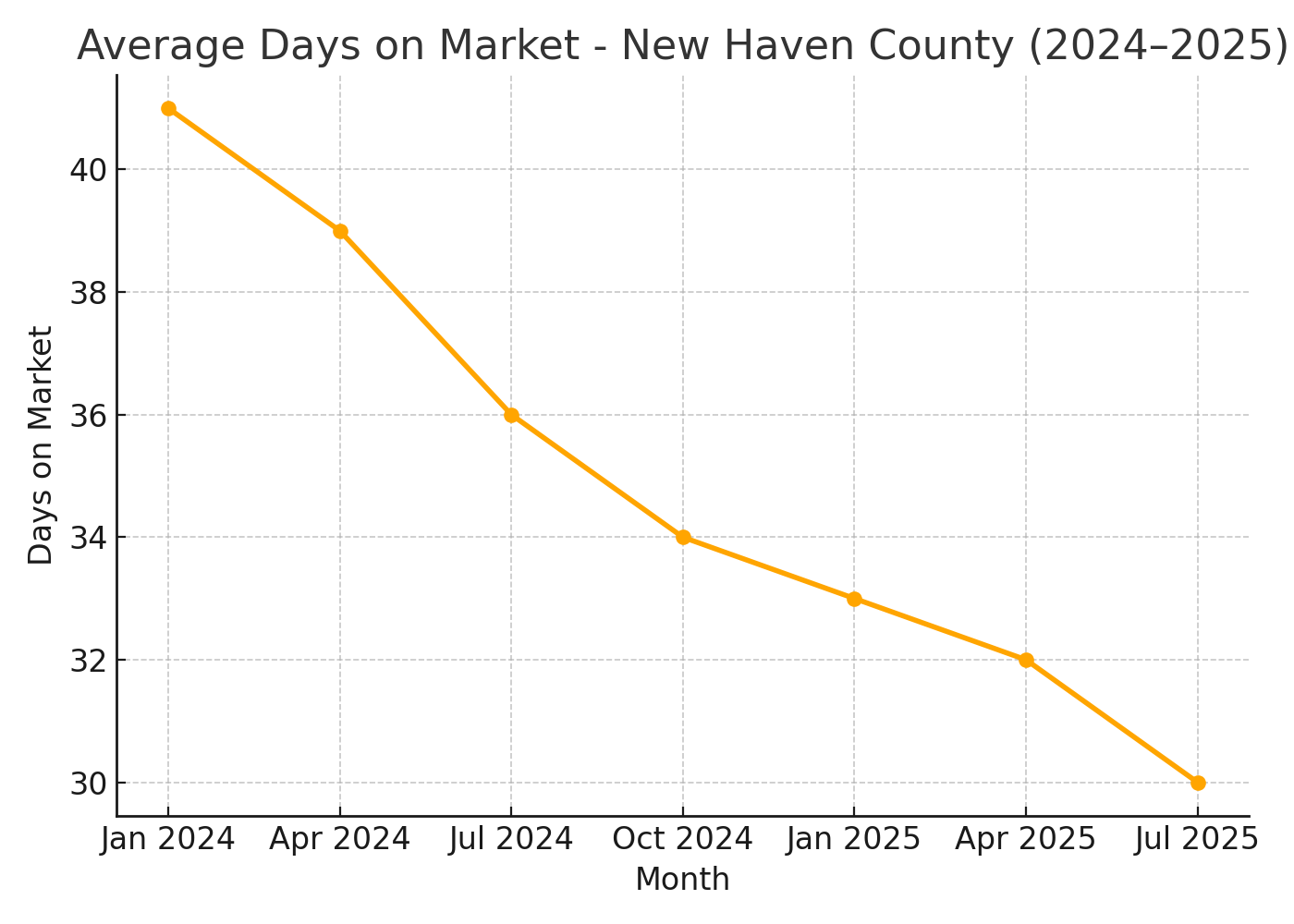

• Homes are selling in an average of 30–35 days across the county.

• Most sellers still get 101–102% of their list price, thanks to strong demand and limited supply.

📈 Median Sale Price – New Haven County (2024–2025)

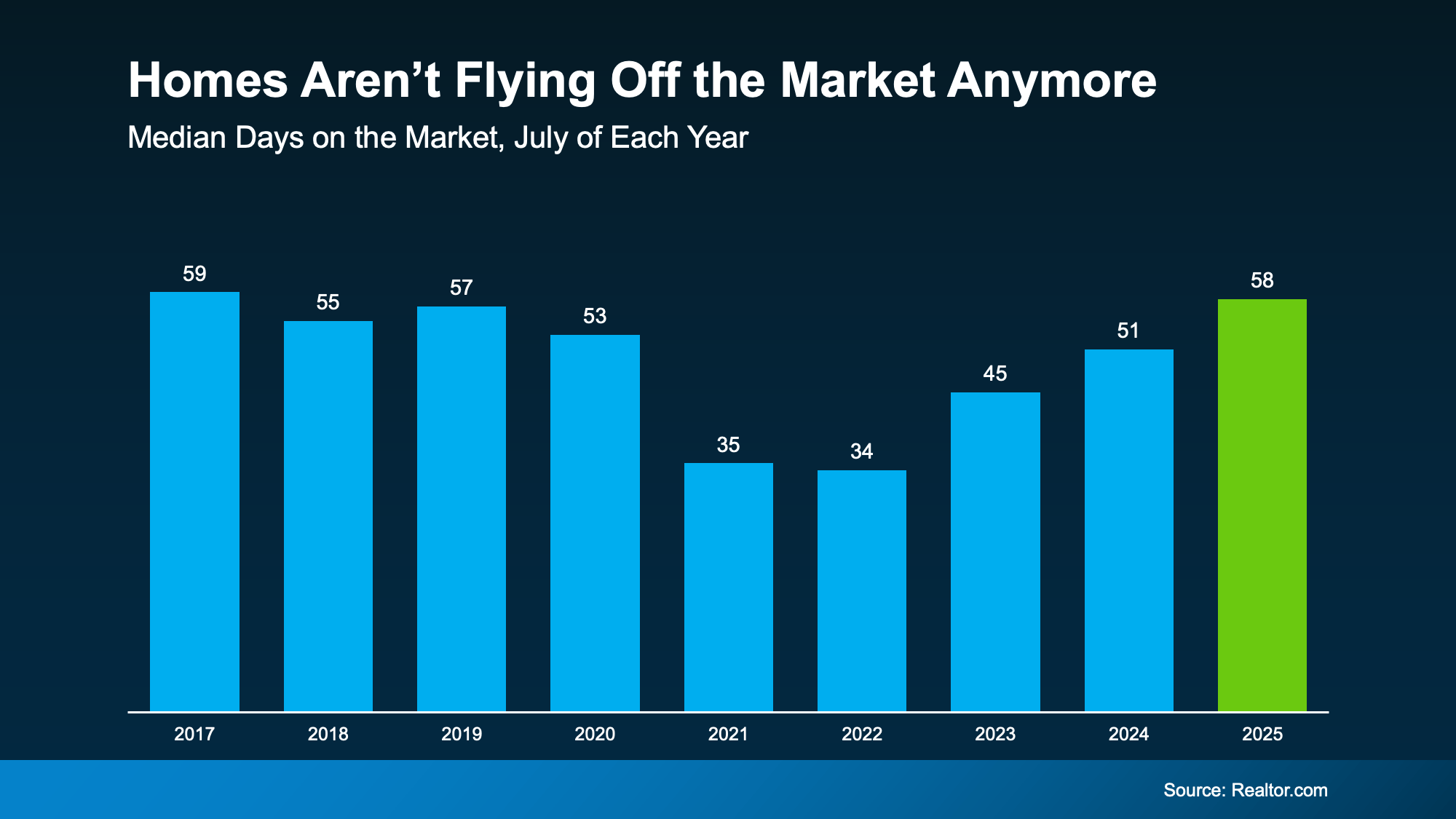

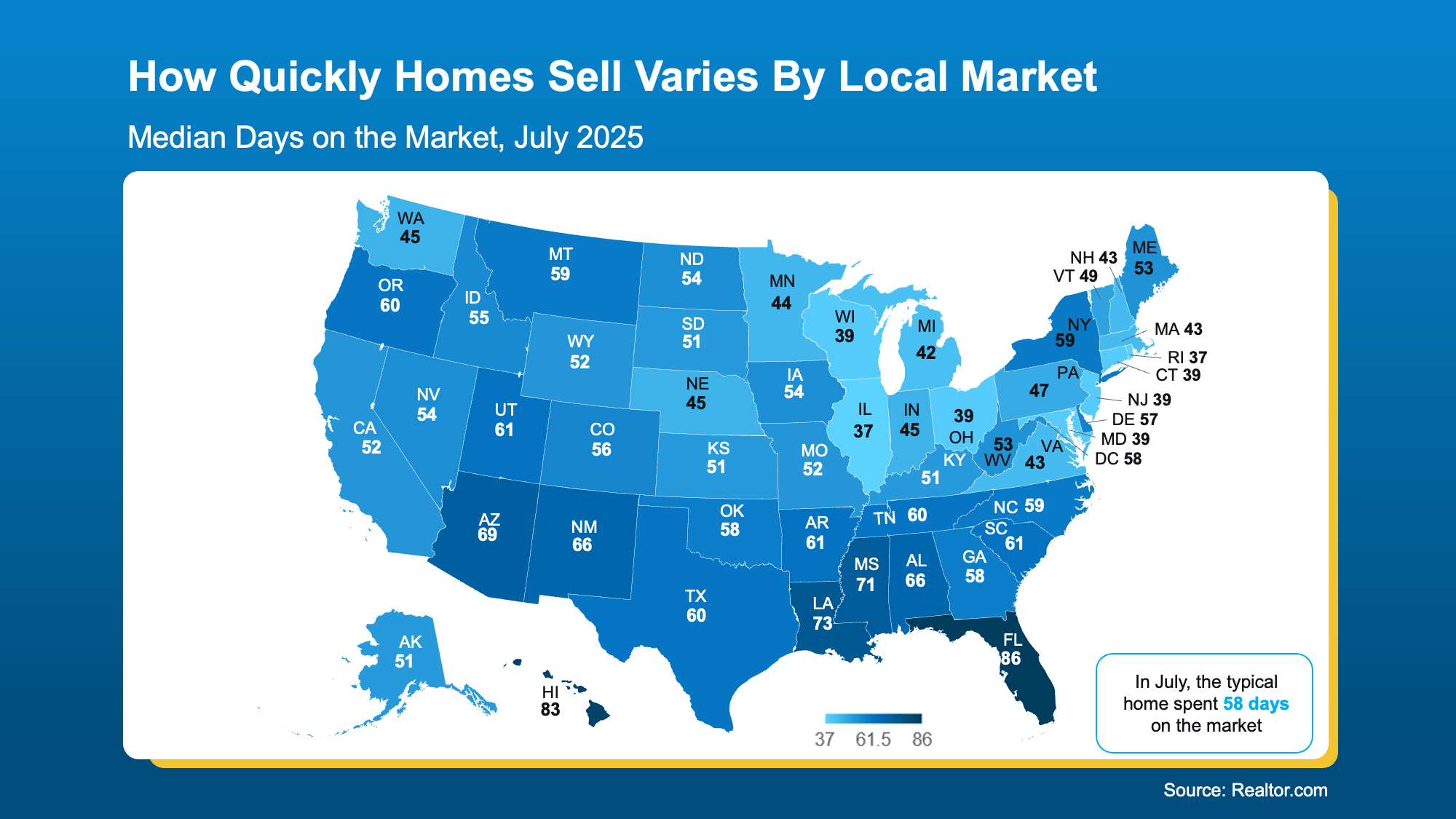

📉 Average Days on Market – New Haven County (2024–2025)

The takeaway? Homes are moving — but pricing and presentation matter more than ever.

5 smart ways to sell fast (without slashing your price)

| Step | What To Focus On | Why It Works |

| 1. Price with precision | Compare similar homes in your neighborhood (not just your town). Adjust for size, upgrades, and location. | Overpricing pushes your listing into the “stale” category. The first two weeks are your best shot at full price. |

| 2. Invest where buyers notice | Fresh paint, landscaping cleanup, lighting updates, and quick repairs. | These small visual boosts add perceived value — buyers judge with their eyes before logic. |

| 3. Stage it for emotion | Clear clutter, open up rooms, add soft touches like fresh flowers and cozy throws. | Staging helps buyers picture themselves there — and emotional connection drives offers. |

| 4. Use professional marketing | Use drone shots, lifestyle photos, and targeted online ads for neighborhoods like East Rock, Wooster Square, and Westville. | Exposure to the right buyers gets you the right price. |

| 5. Move fast when offers come in | Be ready with your numbers and expectations before showings begin. | Quick, confident decisions keep momentum strong — and can prevent buyers from wandering off. |

Neighborhood differences that matter

Selling in Hamden? Highlight proximity to Quinnipiac University.

In Milford or West Haven? Focus on shoreline access and commuter convenience.

For Wallingford, your secret weapon is affordability and central location.

Every pocket of New Haven County has its own buyer type. That’s why I don’t use one-size-fits-all marketing — I tailor it by neighborhood, audience, and lifestyle appeal.

What’s working for sellers right now

Here’s what I’m seeing firsthand across my listings and colleagues at Coldwell Banker:

- Move-in ready homes under $500K are selling in days, not weeks.

• Buyers love energy-efficient updates (new HVACs, solar, and insulated windows).

• Curb appeal is still king — green lawns, power-washed siding, and modern front doors matter more than granite countertops.

• Professional photography and 3D walkthroughs double online clicks compared to “cell phone” listings.

Keep your confidence — and your equity

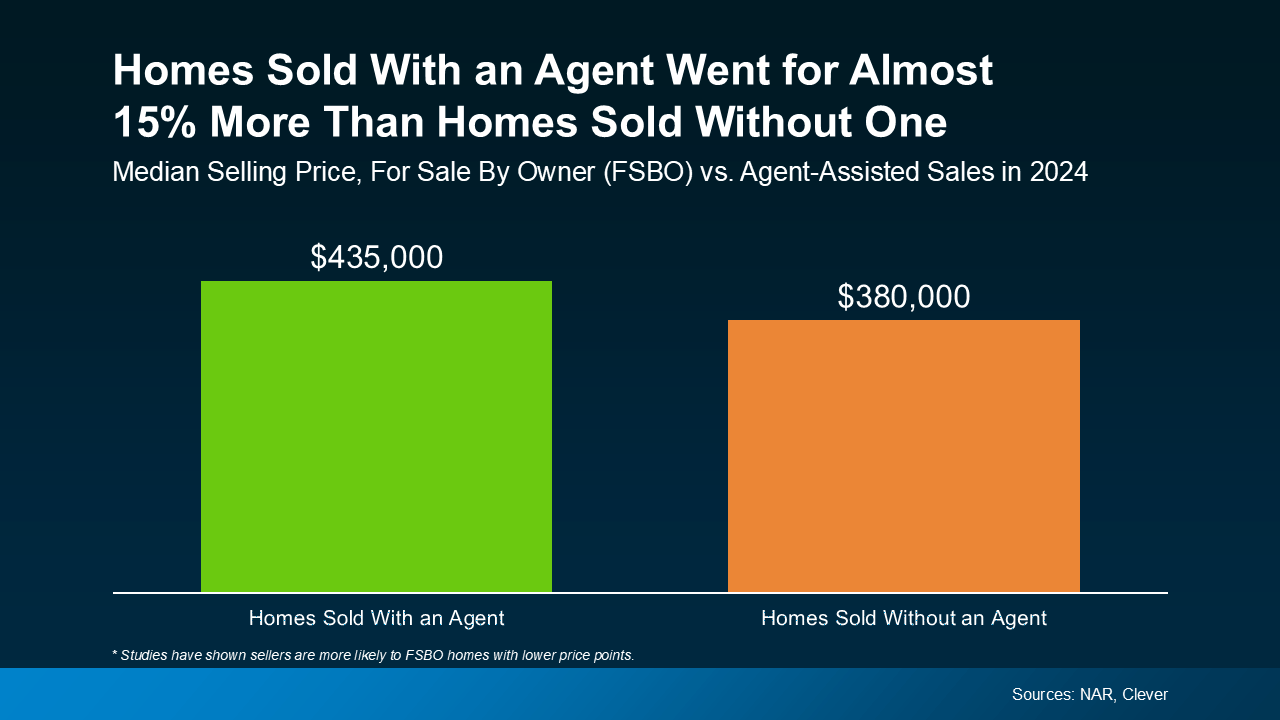

Don’t let anyone pressure you into slashing your price just to “make it move.” With proper prep, strong visuals, and local strategy, your home can attract multiple offers and close quickly — without giving up your hard-earned value.

And yes, it really does help to have a Realtor who knows every corner of this market. I’m not just a name on a sign — I’m in these neighborhoods daily, talking to buyers, agents, and homeowners.

Final thoughts

If you’re planning to sell in New Haven County, here’s my challenge: start early. Even three weeks of prep — decluttering, touch-ups, and a walkthrough with me — can mean a faster, cleaner sale later.

Sell your New Haven County home fast without lowering the price. Local Realtor Heike Severine shares smart pricing and marketing tips.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

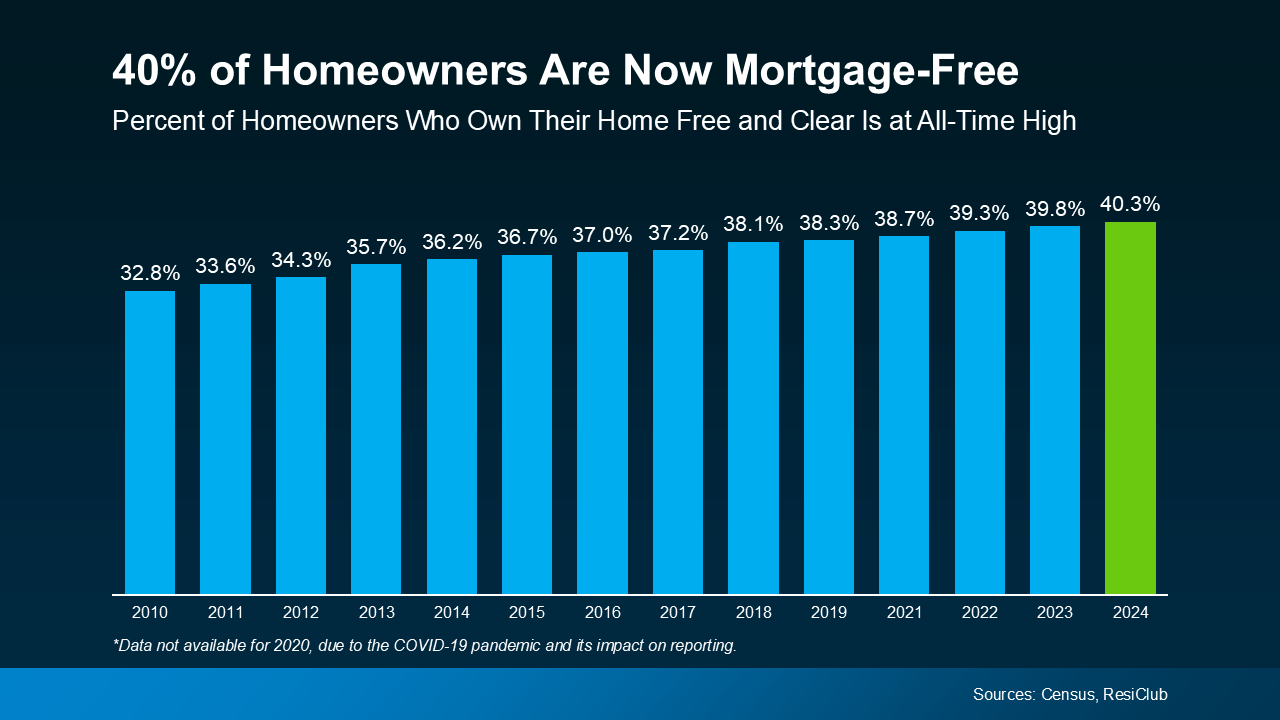

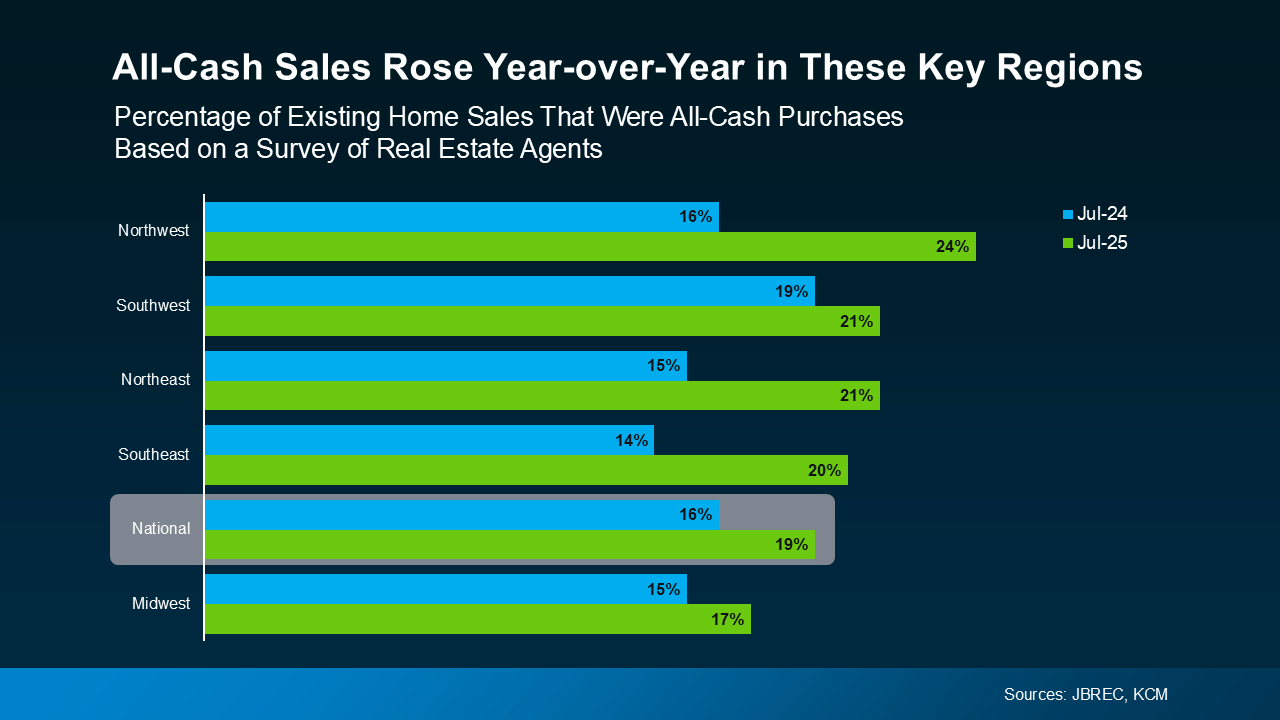

Why This Matters If You’re Selling Your House

Why This Matters If You’re Selling Your House